Financial Capability Snapshot

Ventures joined forces with anchor community organizations to conduct a point in time Financial Capability Snapshot of low-income families in Santa Cruz County. The effort aimed to provide greater understanding behind the high rate of unbanked and underbanked households in the County, as identified by the 2016 Financial Access and Asset Dashboard. A total of 125 surveys were collected during February 2018 from across the County, with over sampling in South county – the region with the highest unbanked and underbanked rates

KEY FINDINGS

RECOMMENDATIONS

ABOUT THE FINANCIAL CAPABILITY SCALE

The University of Wisconsin Center for Financial Security (CFS) and Annie E. Casey Foundation developed a short set of standardized client outcome measures to create the Financial Capability Scale. The Scale is based on a series of subjective self-reported responses, including a mix of reported behaviors, as well as feelings and perceptions. Participants are asked questions around budgeting, confidence, savings, and spending.

PARTNER ORGANIZATIONS

Community Action Board, Goodwill Central Coast, Project SCOUT, and Families in Transition.

ABOUT VENTURES

For over 25 years, Community Ventures has worked to build compassionate and equitable local economies through financial capability, asset building, and advocacy.

KEY FINDINGS

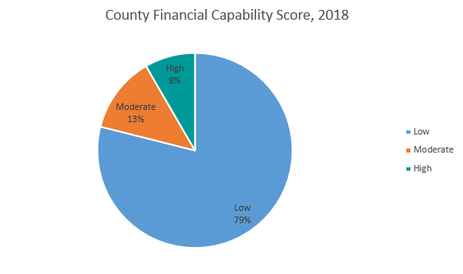

- 79% scored low, which indicates that they more likely to have low assets, earn less and save less, have high levels of debt and financial stress.

- 58% of respondents had expenses that surpass their income.

- 36% of participants said they have incurred late fees in the last 2 months.

- 53% of the community reported they do not use any type of electronic deposit or automatic savings.

- Credit history was more evenly distributed across the county with 39% said they had good credit, 34% said they had Average credit, and 27% said they had Bad credit.

RECOMMENDATIONS

- Increase financial capability resources in county with focus on budgeting and credit. Integrating financial capability with existing programs serving low-income individuals is strongly recommended.

- Invest in youth financial capability. Youth learn financial behaviors from their parents. When parents lack these skills it important for youth to be given the tools to build healthy financial behaviors that set them on a path to strong financial stability.

- Support local vehicles to help families increase income and build wealth. Addressing the income gap by 1) supporting efforts to reduce housing costs and 2) entrepreneurship support including capital and technical assistance.

ABOUT THE FINANCIAL CAPABILITY SCALE

The University of Wisconsin Center for Financial Security (CFS) and Annie E. Casey Foundation developed a short set of standardized client outcome measures to create the Financial Capability Scale. The Scale is based on a series of subjective self-reported responses, including a mix of reported behaviors, as well as feelings and perceptions. Participants are asked questions around budgeting, confidence, savings, and spending.

PARTNER ORGANIZATIONS

Community Action Board, Goodwill Central Coast, Project SCOUT, and Families in Transition.

ABOUT VENTURES

For over 25 years, Community Ventures has worked to build compassionate and equitable local economies through financial capability, asset building, and advocacy.